We've got the perfect lender for your business.

At APPROVE, we don’t limit you to just one lender. We’ve built a powerful network of the nation’s top equipment finance companies to offer you more options. Using advanced data and technology, we match your application with the ideal lenders based on your business’s unique profile. What does this modern approach mean for you? More approvals, better rates, and the perfect fit for your business needs.

Flexible options for unique business needs.

- Finance up to $3,000,000+

- Fast credit decisions

- Potential for multiple approval options from top lenders

- 100% finance for equipment and soft costs

- Terms up to 72 months

- Early-buyout options

- Fast working capital options

- Responsive live assistance from specialized experts

- Entirely streamlined digital process

Fuel your growth with fast, flexible working capital.

Unlock the funds your business needs to thrive with short-term working capital solutions from APPROVE. Whether you’re looking to manage cash flow, take on new projects, or cover unexpected expenses, our working capital loans from $25,000 to $100,000 provide the financial flexibility you need. With a simple application process and terms that fit your business, getting the boost you need has never been easier.

Expert support through every step of the process.

Yes, we’re passionate about solving problems and making things better with technology, but we also know technology can’t replace the trust and high levels of customer satisfaction that can only be earned by giving you easy access to real people.

When you submit your finance application, you will have a dedicated (and friendly) APPROVE Financing Rep to answer your questions and help you clearly understand your options so you can make the smartest financing decision for your business.

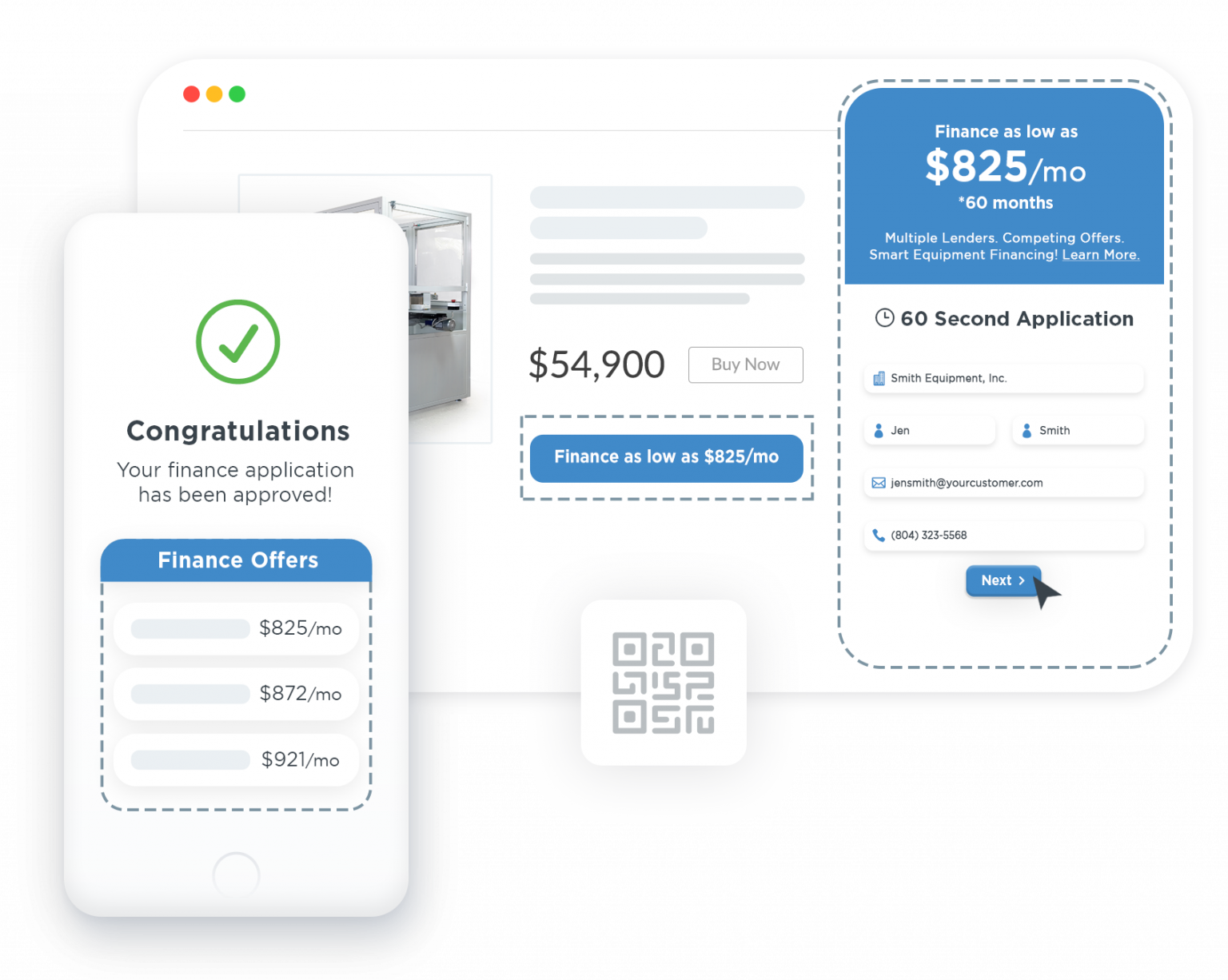

How It Works

STEP 1

Apply Online in 60-Seconds

Provide your information and complete our easy online application in just a minute.

STEP 2

Get Matched with the Perfect Lender

We connect you with our network of top lenders who can offer the best terms for your business.

STEP 3

Choose Terms and Get Your Equipment

Select your financing terms and start using your equipment to grow your business.

Maximize

Approval Chances

Our diverse lender network can approve applications from a far wider range of business types and credit profiles than any individual lender.

Minimize

Financing Costs

Our technology identifies those lenders in the network that are most likely to APPROVE your application and offer you the lowest finance rates.

Make Better

Informed Decisions

Complete one APPROVE application, and we’ll match you with your ideal lender. If multiple lenders fit, you’ll receive offers to compare side-by-side.

to business financing.

How can we support your business today?

|

Acquire essential business equipment while preserving cash flow. Loans have 12-72 month terms, with monthly payments often deductible as business expenses. Builds business credit.

Short term loans (6-24 months) to manage cash flow, seize growth opportunities, and cover temporary cash flow gaps.

|

|

1

Submit Application

|

2

Lenders

Compete |

3

Choose

Best Offer |

Trusted by business leaders across industry sectors.

⭐️⭐️⭐️⭐️⭐️

These guys went beyond the call of duty to help me purchase my machinery. Thank you very much A+.

Dennis D.

⭐️⭐️⭐️⭐️⭐️

Awesome service, very fast response and walked me through the whole process very fast and painless. Definitely will be doing more business in the near future.

Christopher S.

⭐️⭐️⭐️⭐️⭐️

These are some of my favorite people to work with. They are great with my customers!

Jennifer C.

to business financing.

How can we support your business today?

|

Acquire essential business equipment while preserving cash flow. Loans have 12-72 month terms, with monthly payments often deductible as business expenses. Builds business credit.

Short term loans (6-24 months) to manage cash flow, seize growth opportunities, and cover temporary cash flow gaps.

|

|

1

Submit Application

|

2

Lenders

Compete |

3

Choose

Best Offer |